Disney’s Hulu Coup: What’s Changed—and What It Means

- Wale Oredola

- Aug 11, 2025

- 5 min read

Full Ownership Sealed

In June 2025, Disney finalized its acquisition of Comcast’s remaining stake in Hulu, marking a significant milestone in the ongoing evolution of the streaming media landscape. This strategic move involved Disney paying approximately $438.7 million, which was in addition to its substantial initial investment of $8.6 billion made over the preceding years. This acquisition effectively brought Disney's total ownership stake in Hulu to 100%, consolidating its control over the platform.

The decision to acquire the remaining shares from Comcast was influenced by various factors, including the growing competition in the streaming industry and the need for Disney to strengthen its portfolio of streaming services. By fully owning Hulu, Disney aimed to enhance its ability to integrate Hulu’s offerings with its other platforms, such as Disney+ and ESPN+, creating a more cohesive and diverse streaming ecosystem for subscribers.

Hulu, which has been a key player in the streaming market since its launch, offers a unique blend of on-demand content, including a vast library of television shows, movies, and original programming. With Disney now holding complete ownership, there is potential for increased investment in original content, which could attract a wider audience and compete more effectively against rivals like Netflix and Amazon Prime Video.

Additionally, the acquisition allows Disney to leverage Hulu’s existing advertising model, which has been a significant revenue stream. This aspect of Hulu's business could be further optimized under Disney's guidance, potentially leading to innovative advertising solutions that benefit both content creators and advertisers. The full ownership also opens up opportunities for cross-promotional strategies that could enhance viewer engagement across Disney's various media properties.

Overall, this acquisition represents not just a financial transaction but a strategic maneuver that positions Disney as a dominant force in the streaming market. With complete control over Hulu, Disney is poised to capitalize on the platform's strengths while integrating it into its broader vision for the future of entertainment consumption. As the streaming landscape continues to evolve, this move signifies Disney's commitment to staying at the forefront of the industry and adapting to the changing preferences of viewers.

Toward a Unified App

As of August 6, 2025, Disney confirmed plans to fully integrate Hulu into Disney+ by 2026, retiring the standalone Hulu app in favor of a single unified platform. Hulu’s content hub will be replaced globally, with Hulu supplanting Disney’s Star brand internationally.

Disney insists separate Hulu and Disney+ subscriptions will remain available—but all content will be accessible via the new merged experience. Hulu + Live TV subscribers will transition through a joint venture with FuboTV.

Why Disney Made the Move

Operational savings: Analysts estimate that organizations could achieve significant financial benefits, amounting to up to $3 billion, by strategically eliminating redundant technology, data management practices, and administrative costs. This figure represents a substantial opportunity for businesses to streamline their operations and improve overall efficiency. By identifying and removing overlapping systems and processes, companies can not only reduce their expenditures but also enhance their agility in responding to market demands. The elimination of redundant technology often involves consolidating software platforms and systems that serve similar functions, thus reducing licensing fees and maintenance costs. In addition, by optimizing data management practices, organizations can minimize the expenses associated with data storage and processing, leading to more effective resource allocation. Furthermore, addressing administrative costs by automating routine tasks and improving workflows can result in a leaner operational structure, allowing employees to focus on higher-value activities that drive growth and innovation. Overall, the potential for operational savings is not just about cutting costs; it also encompasses the opportunity to reinvest those savings into core business initiatives, thereby fostering a more competitive and sustainable business model in the long run.

Ad tech integration: The integration of advertising technology under Disney’s innovative “Mission Control” framework represents a significant advancement in the way digital advertising is executed across multiple platforms. This streamlined ad serving process not only enhances efficiency but also enables advertisers to execute unified ad campaigns that target diverse audience pools across both Disney+ and Hulu. By leveraging sophisticated data analytics and audience segmentation tools, advertisers can tailor their messages to resonate more effectively with specific demographics, ensuring that their campaigns achieve maximum impact. Furthermore, this integration allows for real-time optimization of ad placements, enabling marketers to adjust their strategies based on live performance metrics and viewer engagement. As a result, brands can make informed decisions that enhance their return on investment. The collaboration of these two major streaming services under a single ad tech umbrella also facilitates a seamless user experience, as audiences are exposed to relevant advertisements that align with their viewing habits and preferences. Overall, Disney's “Mission Control” not only streamlines the ad serving process but also represents a forward-thinking approach to digital marketing, fostering a more cohesive and effective advertising environment that benefits both advertisers and consumers alike.

Churn reduction & engagement:

Disney claims integration will elevate engagement, lower churn, and improve advertising revenue persistence.

Business Momentum

Disney’s streaming segment—covering Disney+, Hulu, and ESPN+—reported $6.2 billion revenue in Q3 FY 2025 (to June 28), up 6 % year-over-year, and $346 million operating income, swinging from a loss in Q3 2024. Disney has raised its full-year streaming profitability forecast to $1.3 billion, up from $1.0 billion.

Disney now plans to stop reporting subscriber counts and ARPU beginning Q1 FY 2026, arguing these metrics are now less meaningful given the unified business model.

Implications for Production Companies

Premium Long‑Form Content Still King

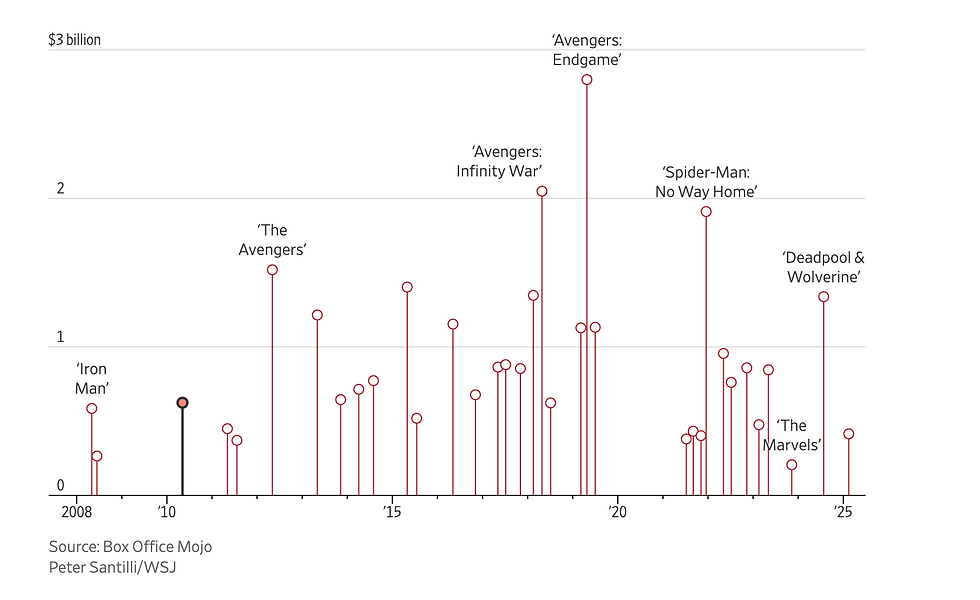

Disney’s content strategy spans from tentpole franchise films (Marvel, Star Wars) to Hulu’s prestige dramas and documentaries. Production studios that can deliver both high‑quality IP and niche adult storytelling will win in this bundled ecosystem.

Demand for Versatility

Studios must create content that fits multi‑demographic universes—from family‑friendly Disney+ fare to more adult‑oriented Hulu originals. Flexibility in tone and format is increasingly valued.

Advertising & Financing Evolution

With ads now unified across platforms, production companies—especially those working in ad‑supported tiers—may see new revenue models tied to campaign targeting and interstitial ad placements alongside creative credits and promotional opportunities.

Greater Pressure on Mid‑Budget Drama & Franchise Initiatives

Disney’s unified model means content with built‑in fanbases (e.g. Marvel spinoffs) and prestige series that engage audiences over longer terms will be favored—potentially crowding out mid‑tier standalone shows.

Streaming in General: Industry Context

Consolidation & Ecosystems

Disney’s move reflects a broader trend: consolidation around mega‑apps (think Amazon Prime Video bundling, Max/Discovery). Streamers are evolving into content ecosystems anchored by IP plus licensed third‑party programming.

Live Sports as Subscriber Magnet

Disney’s standalone ESPN streaming service launches August 21, 2025 at $29.99/month, offering ESPN linear channels and ESPN+ content. It’s bundled with Disney+ and Hulu for unified customers.

Disney also struck deals to house WWE premium live events and NFL Network content inside ESPN, bolstering sports exclusivity.

OTT Dominates Global Consumption

By 2025, over‑the‑top (OTT) streaming surpassed combined broadcast and cable viewing in the U.S., and now makes up the majority of global TV consumption—pushing studios to produce globally relevant content and adjust to viewing habits.

Personalized Recommendations & AI

As content volumes grow, platforms focus on recommendation engines and metadata enhancements. Disney’s backend unification supports a more seamless, personalized discovery experience—demanding richer tagging and standardized metadata from production partners.

📌 Takeaways

Stakeholder | Key Implication |

Disney | Streamlined tech, unified app boosts margin, reduces churn, opens targeted ad revenue and positions for long-term scale. |

Consumers | Access to broad Disney+ and Hulu content in one interface, plus ESPN sports options in one ecosystem—even while retaining flexible subscription choices. |

Production Companies | Must deliver scalable, brand‑driven IP alongside quality adult content; adapt to enhanced metadata requirements and sophisticated ad‑based monetization models. |

Streaming Industry | Expect more bundling, consolidation, sports-driven subscription models, global OTT dominance, and platform-first data strategies. |

🎯 Final Thought

Disney’s Hulu integration is a watershed moment—signaling the next era of streaming: unified platforms, sports-infused content ecosystems, and smarter monetization. The impact on production companies is significant: flexibility, metadata discipline, and IP alignment are non-negotiable. In a landscape where OTT dominates global viewership, content is still king—but the platform’s ability to curate, recommend, bundle, and monetize effectively may matter even more.

Comments